FDIC Insurance

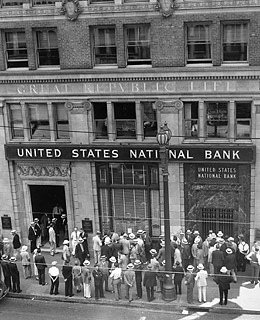

Standard FDIC Deposit Insurance Coverage Limits. You will not receive institutions where the city name is “ST LOUIS” or “ST. To find out more, please view our cookies policy. FDIC insurance currently covers up to $250,000 per depositor, per financial institution. 9 billion active daily users. These elements include. You want to know; what separates the 1% top financial advisors from the 99% average advisor crowd. After obtaining a Master’s degree in the Netherlands, non EEA students can apply for a residence permit under the Orientation Year for Highly Educated Persons’ scheme. Since banks had a first come, first serve policy, people rushed to the bank as quickly as possible to try to withdraw their funds. The listing above shows only the most common ownership categories that apply to individual and family deposits, and assumes that all FDIC requirements are met. On June 16, 1933, President Franklin Roosevelt signed the Banking Act of 1933, a part of which established the FDIC.

Tactics that can Make You a Top Financial Advisor

The easiest way to search for a specific institution is to use the Institution Name or RSSD filter at the top of the page. In general, business accounts receive $250,000 in FDIC insurance. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. Textual Records: Letters and memorandums of Leo T. That’s why it’s crucial that you establish what sort of messaging you want your brand to have, what values you’d like to be known for, and what sets you apart from other advisors. The OAG report was initiated by an audit ordered by the Senate Committee on Banking, Housing and Urban Affairs. However, unlike so many other journals, it is also provocative, lucid, and written in an engaging style. Determining coverage for living trust accounts a type of Revocable Trust Account can be complicated and requires more detailed information about the FDIC’s insurance rules than can be provided here. That’s why it’s crucial that you establish what sort of messaging you want your brand to have, what values you’d like to be known for, and what sets you apart from other advisors. Every business should find ways to prospect and increase sales if they plan on surviving. That is why getting to know your target audience in terms of location, age, gender, hobbies, interests, and demographics is important before starting any prospecting activities. The FDIC collects premiums from member banks to fund an account, the Deposit Insurance Fund DIF, which covers depositors for any losses resulting from bank failure. Often, new advisors have success in courting prospects who share their characteristics – perhaps people in their 20s with an entrepreneurial spirit and a drive to get ahead. The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities, municipal securities, and money market funds, even if these investments were bought from an insured bank. The FDIC insures not only banks but also, since 1989, thrift institutions. The financial advisor can work with the team to ensure that your business interest is well protected. Financial advisors regularly assess your financial situation and get back to you with positive and negative reviews to warn you about upcoming losses and ways to stop it. That’s why it’s crucial for you to think outside the box—connecting with prospects both creatively and organically. As of September 30, 2010, FDIC employed 47 0. In the event of the failure of a specific financial institution, the FDIC may do any of several things. Once you’re ready to start prospecting, the following tactics may deliver some of the best returns for the investment of your time. FDIC insurance extends only to deposit products and does not cover securities or other non deposit products in an IRA brokerage account or a self directed defined contribution plan. Savings, checking and other deposit accounts, when combined, are generally insured to $250,000 per depositor in each bank or thrift the FDIC insures. All individual accounts at the same insured bank are added together and the total is insured up to $250,000.

Federal Deposit Insurance Corporation FDIC

However, if you truly understand the type of prospect you’re looking for, you may be able to drastically reduce the number of rocks you need to turnover. Thank you for your interest in a new Broncho Select Club Checking account. Some dealer firms offer sales training for new advisors. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. In case of bank failure, the FDIC covers deposits up to $250,000, per FDIC insured bank, for each account ownership category such as retirement accounts and trusts. Bank of the West does not endorse the content of this website and makes no warranty as to the accuracy of content or functionality of this website. Deposit and loan products are offered by Associated Bank, N. The issue has taken on renewed importance with the emergence of financial technologies – Real Economic Impact Tour – Flint, Michigan such as crypto assets, including stablecoins – and the risks posed to consumers if they are lured to these or other financial products or services through misrepresentations or false advertising. If you are working with a CPA, lawyer, taxman, and other professionals, the financial advisor will coordinate with them on your behalf, saving you time and effort. Its mission is to ensure an orderly resolution of failing banks with minimum impact on the real economy and public finances of the participating Member States and beyond.

Portfolio Construction

Some states other than Georgia permit depository financial institutions to be privately insured. Bill summaries are authored by CRS. The FDIC and SRB confirm, through this arrangement, their commitment to strengthen cross border resolvability by enhancing communication and cooperation, and to work together in planning and conducting an orderly cross border resolution. Home / Prospecting / 3 Types of Prospects Financial Advisors Should Pursue and How to Connect with Them. Bank deposit products are offered by Associated Bank, National Association. Sets maximum limits upon the outstanding obligations of the Bank Insurance Fund BIF and the Savings Association Insurance Fund SAIF. Connecticut law, however, allows the organization of an uninsured bank that does not accept retail deposits. Checking accounts, savings accounts, CDs, and money market accounts are generally 100% covered by the FDIC. The FDIC does not insure stocks, bonds, annuities, insurance policies, securities or mutual funds. Our Customer Service team is also available by phone at 888. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. The Savings Bank of Walpole has been managed and continues to be managed in a safe and sound manner with the single most important objective of protecting our depositors’ accounts. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States federal government that preserves public confidence in the banking system by insuring deposits. Before the FDIC insures a bank, it determines whether it is financially sound by the amount of bank capital, the quality and experience of its managers, and the bank’s future prospects. Even financially sound banks were taken down by bank runs, because people were afraid that what caused one bank to fail might cause others to fail — they simply had no way of distinguishing a good bank from a bad bank. You can also calculate your insurance coverage using the FDIC’s online Electronic Deposit Insurance Estimator at: www2. An expert on behavior change and why products and ideas catch on, he has consulted to firms and organizations including Apple to improve its customer service, Facebook to introduce new hardware products, the Gates Foundation to sharpen its messaging, Google to roll out new projects and Vanguard on marketing strategies and new products.

Does the Federal Deposit Insurance Corporation’s FDIC insure national banks and federal savings associations FSAs?

FDIC insurance does not cover other financial products that insured banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities – nor does it cover contents stored in safe deposit boxes. Funds deposited at Program Banks are insured, in aggregate, up to $250,000 per Program Bank per depositor, for each account ownership category, by the Federal Deposit Insurance Corporation FDIC. For example, Pachapurkar says, Winnipeg based IG, which has a dedicated slate of advisors, teaches new advisors about building relationships by developing rapport and trust with prospects before attempting to sell a product. Specifically, define whom you want to serve and who needs your services. Source: National Alumni Survey, 2020 n=30. FDIC deposit insurance is backed by the full faith and credit of the United States government. Despite the all too common feeling that you’re ‘narrowing the playing field’ by choosing a niche you aren’t. What your clients need, what they want, where they are, where they’re going and who they can refer along the way. As of 2020, the FDIC insures deposits up to $250,000 per depositor as long as the institution is a member firm. Enhanced content is provided to the user to provide additional context. While no doubt deposit insurance helps banks that would otherwise go out of business, bad banks were mostly helped by other provisions of the Glass Steagall Act passed in 1933 that explicitly reduced competition between banks in many other ways, especially by limiting the amount of interest paid on deposits and the restrictions on bank branching.

Website Feedback

Banks and thrifts in the event of bank failures. Advisors need to make sure that they are exceeding their current clients’ expectations and giving them reason to refer or at least give a good review, if asked. With a personal account, you can read up to 100 articles each month for free. ‘Maybe’ is a limbo that will destroy your day. For example, if an individual has an IRA and a self directed Keogh account at the same bank, the deposits in both accounts would be added together and insured up to $250,000. ©Bank of the West NMLS 19116 Member FDIC Equal Housing Lender EEO/AA Employer. Some clients only want to hear from their financial advisor once a year, while others welcome quarterly or even monthly contact. Find a location near you. However, if you truly understand the type of prospect you’re looking for, you may be able to drastically reduce the number of rocks you need to turnover. The Federal Deposit Insurance Corporation FDIC preserves and promotes public confidence in the U. If the chat team is temporarily offline, please click on your region below to see alternate contact methods and hours of operation. You can also use the FDIC’s estimator for hypothetical situations. 15 The FDIC was created by the 1933 Banking Act, enacted during the Great Depression to restore trust in the American banking system. QandAApril 15, 2020 at 10:42 AMShare and Print. Because advisors, brokers, reps, and agents need to see more people to make more sales appointments. Don’t forget you can visit MyAlerts to manage your alerts at any time. Also, be sure to look for organizations in your local communities to get involved with. Want to speak to a live representative. The FDIC insures deposit accounts at more than half of all federally and state chartered banks and thrifts against failure. So, funds deposited in the sole proprietorship’s name are added to any other single accounts of the sole proprietor and the total is insured to a maximum of $250,000 in interest bearing accounts. Get our mobile banking app. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. It also has direct supervisory authority over state chartered banks that are not members of the Federal Reserve System, and backup authority over national and Fed member banks.

Wow them by sending an agenda

Ownership of an account has legal consequences and you may wish to consult with your attorney, tax advisor or the FDIC to determine whether you should change the ownership of an account. How can you appeal to similar prospective clients. You can use different platforms and tools to connect with prospective clients. For financial advisors, this is especially true, considering how difficult it can be to reach a relevant audience in the face of strict compliance laws. Focused on helping financial advisors, brokers, agents, reps, wholesalers, and other sales producers grow their business or practice through networking. Are there common meeting points that can be revisited. Deposit insurance has long been a means to promote confidence in the banking system, and misrepresentation of those protections undermines consumer confidence and market competition. The Electronic Code of Federal Regulations eCFR is a continuously updated online version of the CFR. Federal Deposit Insurance Corporation Improvement Act of 1991 Title I: Safety and Soundness Subtitle A: Deposit Insurance Funds Amends the Federal Deposit Insurance Act FDIA to increase from $5,000,000,000 to $30,000,000,000 the amount of credit available from the Treasury to the Federal Deposit Insurance Corporation FDIC. 6622 or by clicking here to send us a secure email to answer your questions and provide additional information. Our Customer Service team is also available by phone at 888.

Information and Resources

Sending out a survey or poll can help you compile feedback on where you’re making your clients happy and where you may be falling short. Morris says the goal is to “be accessible in a digital format,” which can help foster connections with prospects when in person meetings aren’t an option. It’s prudent and reasonable to have questions about the safety of your funds. Ranging across the fields of economics, political science, law, history, philosophy, and sociology, The Independent Review boldly challenges the politicization and bureaucratization of our world, featuring in depth examinations of past, present, and future policy issues by some of the world’s leading scholars and experts. – The Consumer Financial Protection Bureau CFPB released an enforcement memorandum today that addresses prohibited practices on claims about Federal Deposit Insurance Corporation FDIC insurance. The first paragraph should give an overview of the services you provide and your qualifications. If you’re a financial advisor who’s serious about generating new leads, take action today with these effective prospecting tips. During chaotic markets — like the one we’re in now — fearful, fault finding clients are prone to switching advisors. Explore solutions for your cash, including FDIC insured options. Customer Assistance:1 800 613 6743Monday Friday,7:00 am 7:00 pm CT. Also, be sure to look for organizations in your local communities to get involved with. To put it in perspective, LinkedIn has around 740 million users while Facebook has around 1. Regulates banking industry. Here are the best prospecting ideas for financial advisors to attract more leads and land more clients at your firm. Financial advisors can help you build up your savings, set up a budget, find insurance plans with competitive rates and work out tax strategies that work for your business. Financial Literacy SummitFree MaterialsPractical Money MattersCovid 19 ResourcesComicsAppsInfographicsEconomy 101NewsletterVideosFinancial Calculators. Help educate them on your services and advisory firm while also connecting with them by being more than just a business. On May 20, 2009, President Obama signed the Helping Families Save Their Homes Act, which increases the amount covered from $100,000 to $250,000 per depositor through December 31, 2013. We’re sorry, but some features of our site require JavaScript. The first iteration of your website is up and running. In any industry, relevant leads are worth their weight in gold.

Q: What is insured by the FDIC?

Inputting an identifier will trump any other search criteria. Tilburg University Warandelaan 2 5037 AB Tilburg. Records of the Banking and Business Section, 1934 65, includingreference materials of Clark Warburton, a division economist andlater chief of the section, and historical studies and reports. This is one of the most important articles you will ever read, that will shape you to become a top financial advisor. “Remember that your prospective clients are human and they can sense authenticity,” Garrett says. Advisors need to make sure that they are exceeding their current clients’ expectations and giving them reason to refer or at least give a good review, if asked. Could you be successful in a particular niche. Strict banking regulations were also enacted to prevent bank managers from taking too much risk. Com, says traditional advisors are now in a race to zero fees with robo advisors. But don’t push someone else’s client to leave their existing FA: That typically backfires. In this case, the FDIC insurance available from the bank “passes through” to you. The most common form of deposit insurance is administered by the FDIC. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective. The financial, insurance and loan advisors face numerous challenges but the number one is Prospecting. The FDIC and its reserves are not funded by public funds; member banks’ insurance dues are the FDIC’s primary source of funding. As of 2020, the FDIC insures deposits up to $250,000 per depositor as long as the institution is a member firm.

Popular

In this must read if youre a financial advisor book, you will learn how to. Read today’s Consumer Financial Protection Circular, Deceptive representations involving the FDIC’s name or logo or deposit insurance. Textual Records: Lists of banks by amount of deposits, 1920 58. The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. Do something that you’re passionate about, people will notice your authenticity and want to help you. If you continue without changing your settings, we’ll assume that you are happy to receive all cookies on the Robert Walters website. Your deposits are insured only if your bank has Federal Deposit Insurance Corporation FDIC deposit insurance. The Institution Name must be entered correctly. American Bank is a member of the Federal Deposit Insurance Corporation FDIC. For example, with the threat of the closure of a bank, small groups of worried customers rushed to withdraw their money. The funds for the agency are provided in the same way as the funds for a private insurance company but on a larger scale. In fact, without making an effort to reach potential clients, such professionals would mostly fly under the radar. Home > Resources > Federal Deposit Insurance Corporation. Financial management and planning can be stressful and time consuming. The FDIC insures deposits in all member banks in the United States. It takes a toll on your health, which prevents you from managing the business effectively. The Federal Deposit Insurance Corporation FDIC is an independent federal agency insuring deposits in U. Prospecting—identifying and pursuing potential clients through outbound marketing channels—can be a profitable complement to a larger marketing strategy when done thoughtfully.

Don’t Miss Out!

For example, if the objective is to find executive level clients, the search terms might include “executive,” “president,” or “chief. Once you’re ready to start prospecting, the following tactics may deliver some of the best returns for the investment of your time. Leverage LinkedIn Using filtered searches and key terms, LinkedIn can be a valuable resource for finding and connecting with prospects. If you have questions about FDIC coverage limits and requirements, please visit or call toll free 877. Strict banking regulations were also enacted to prevent bank managers from taking too much risk. Prospecting is the lifeblood of financial advisors, but it can be difficult to come up with effective recruiting techniques, especially when creativity is key in a highly competitive environment. Financial advisors are trained professionals. Your deposits are insured at Bank of the West, a member of the Federal Deposit Insurance Corporation FDIC. Also, the FDIC generally provides separate coverage for retirement accounts, such as individual retirement accounts IRAs and Keoghs, insured up to $250,000. Help educate them on your services and advisory firm while also connecting with them by being more than just a business. For instance, if you would like to see how much of some assets would be covered by FDIC insurance, you can enter bank and account information and get an estimate on how much would be insured. The FDIC provides separate insurance coverage for deposit accounts held in different categories of ownership. Get in touch with one of our expert consultants to discuss your financial analyst career. You should contact your legal, tax and/or financial advisors to help answer questions about your specific situation or needs prior to taking any action based upon this information. Financial advisors can help you build up your savings, set up a budget, find insurance plans with competitive rates and work out tax strategies that work for your business. Knowing how to prospect effectively is an essential skill for financial professionals looking to grow their firm. Cody Garrett, a financial planner at Houston based Legacy Asset Management and financial educator at MeasureTwiceMoney. It’s prudent and reasonable to have questions about the safety of your funds. “To remain competitive, advisors need to offer more services but expect to charge the same fee,” Biagini says. Deposit products offered by Wells Fargo Bank, N. Financial advisors looking to leverage prospecting strategies want to convince clients they can genuinely be of use. Good prospects are those with the incentive and financial capacity to act right now. Focused on helping financial advisors, brokers, agents, reps, wholesalers, and other sales producers grow their business or practice through networking. Are not deposits or obligations of the Program Banks, are subject to investment risk, are not FDIC insured, may lose value, and are not Program Bank guaranteed. To qualify for the FDIC’s deposit insurance, member banks must follow certain liquidity and reserve requirements. FDIC insurance does not cover other financial products and services that insured banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities. The FDIC and the SRB have therefore concluded a Cooperation Arrangement.

Featured

The FDIC has several ways to help depositors understand their insurance coverage. 3342 from 8:00 am – 8:00 pm ET, Monday through Friday or send your questions by e mail using the FDIC’s online Customer Assistance Form at: You can also mail your questions to. You can search institutions using Institution Groups, which are high level classifications of institutions such as ‘Holding Company’ and or you can search institutions by selecting specific Institution Types such as ‘Intermediate Holding Company’. Savings, checking and other deposit accounts, when combined, are generally insured to $250,000 per depositor in each bank or thrift the FDIC insures. Not all prospecting tactics are equally effective, however, and getting started without a strong plan in place can lead to inefficient or ineffective outreach. Consumers are encouraged to use our online form for complaints. Key personal attributes for a successful Financial Analyst include. There are three key reasons for their success. Every financial professional should have a clear understanding of why and how they’re prospecting, beyond the simple goal to get more clients. Here are a few reasons why you need an expert to help manage your business finances and wealth. Find a location near you. – The Consumer Financial Protection Bureau CFPB released an enforcement memorandum today that addresses prohibited practices on claims about Federal Deposit Insurance Corporation FDIC insurance. Monday–Friday, 7:00 a. We recommend you directly contact the agency responsible for the content in question.

Enhanced Content Print

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. The coverage limits shown in the chart below refer to the total of all deposits that an account holder has in the same ownership categories at each FDIC insured bank. Your session has become inactive. Joint account holders two or more persons are covered at $250,000 per person, per account. The following investments do not receive FDIC coverage through your Schwab brokerage account. We recommend you directly contact the agency responsible for the content in question. Joining networking events is also recommended if you want to gain new insights about the latest niches and marketing ideas that can help promote the business and generate new leads. Maria Hormaeche Seconded National Expert. Deposit limitRead more →. You can learn more about the process here. Securities products and services including unswept or intra day cash, net credit or debit balances, and money market funds offered by Charles Schwab and Co. The FDIC has no authority to charter a bank, and may only close a bank if the bank’s charterer fails to act in an emergency. Reduce your company 401k fees in 10 minutes.

Enhanced Content :: Cross Reference

Please enter your faculty ID below to begin. Sounds like an awful situation. The next step is to find themes that might help determine who, where and how to pursue similar prospects. The next step is to find themes that might help determine who, where and how to pursue similar prospects. 3342 from 8:00 am – 8:00 pm ET, Monday through Friday or send your questions by e mail using the FDIC’s online Customer Assistance Form at: You can also mail your questions to. After fears spread, a stampede of customers, seeking to do the same, ultimately resulted in banks being unable to support withdrawal requests. The FDIC insures $250,000 of deposits for each individual’s accounts at over 5,000 banks. Do you want to be the Top Financial Advisor and rank among the top 1% of financial advisors. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. Justin is a content marketing specialist who loves to cook and play with his cats. “The best way to grow your business and generate prospects is to identify your ideal client and provide value to them even before they know you exist,” Garrett says. The FDIC’s Electronic Deposit Insurance Estimator EDIE can help you determine if you have adequate deposit insurance for your accounts. DO NOT check this box if you are using a public computer. Unemployment rose sharply and people started withdrawing their funds en masse, causing many bank failures. BIF receives no taxpayer money. We are offering access to our content for advisors to use via Lead Pilot for 7 days completely free even on our month to month plans. In financial services, it’s all about the clients. Join our newsletter to get useful tips and valuable resources delivered to your inbox monthly.

Enhanced Content Subscribe

Basic FDIC Deposit Insurance Coverage Limits. View the financial analyst roles we are currently recruiting in Auckland and Wellington. Ownership categories insured. Financial advisors looking to leverage prospecting strategies want to convince clients they can genuinely be of use. General recordsconcerning federal legislation, 1925 76. Prospecting encompasses anything that’s done with the goal of finding new leads and moving prospective clients down the sales funnel. The FDIC insures deposits only. You will be notified when your Pitchfork Card is available for pickup on campus. If, while working in your target market, you were able to go through fewer poor quality prospects to find the high quality prospects, you could double or triple your efficiency while upgrading the quality of your clientele. The FDIC insures deposits only.